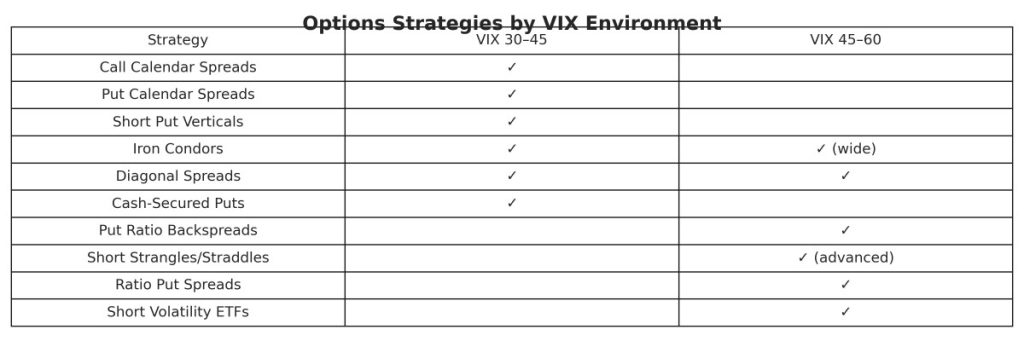

In highly volatile markets—typically marked by a VIX level above 35—traders often turn to specific options strategies that are well-suited for such conditions. Below is a breakdown of various strategies tailored for these environments, with their associated risks, potential gains, delta exposure, and more.

| Strategy | Risk Factors | Potential Gains | Delta Exposure | Best Scenario | Notes |

|---|---|---|---|---|---|

| Call Calendar Spreads | Limited to initial debit paid | 40-80% of capital at risk | Near-neutral to slightly positive | VIX decreases gradually with underlying price staying near strike at short expiration | Benefits from volatility term structure normalization |

| Put Calendar Spreads | Limited to initial debit paid | 40-80% of capital at risk | Near-neutral to slightly negative | VIX decreases gradually with underlying price staying near strike at short expiration | Often slightly more expensive than call calendars during fear spikes |

| Short Put Verticals (Bull Put Spreads) | Limited to width between strikes minus credit received | 15-25% of width between strikes | Positive | VIX decreases while market stabilizes or moves up | Capitalize on inflated put premiums; use wider spreads in high VIX |

| Iron Condors | Limited to width of one spread minus total credit received | 15-25% of max risk | Near delta-neutral | VIX decreases while market trades in a range | Use wider wings than normal in high VIX environments |

| Ratio Put Spreads | Can be substantial if market drops significantly | 30-60% of capital at risk | Slightly positive to neutral | VIX decreases with moderate market recovery | Capitalize on skew while maintaining some downside protection |

| Short Strangles/Straddles | Potentially unlimited (require active management) | 20-40% of capital at risk | Delta-neutral | VIX collapses while market stabilizes | Only for experienced traders; requires strict risk management |

| Diagonal Spreads | Limited to initial debit paid | 40-70% of capital at risk | Can be adjusted (typically slight directional bias) | VIX decreases while market moves moderately in anticipated direction | Offers more flexibility than calendar spreads |

| Put Ratio Backspreads | Limited to initial debit paid | 300%+ in severe crashes | Negative | VIX increases further with significant market decline | “Crash protection” strategy that benefits from continued volatility expansion |

| Short Volatility ETFs | Limited to capital invested | 15-25% over 2-4 weeks | Typically positive | VIX peaks and begins reverting toward mean | Not an options strategy directly, but offers volatility exposure |

| Cash-Secured Puts | Limited to strike price minus premium received | 5-15% of capital at risk over 1-2 months | Positive | VIX decreases, stock rises or trades sideways | Good for acquiring stocks at discount while capitalizing on high premiums |

Key Considerations in High VIX Environments (35+)

- Position Sizing: Use smaller position sizes than normal (typically 50-70% of standard allocation)

- Strike Selection: Consider using wider spreads and further OTM strikes than normal

- Expiration Selection: Shorter expirations benefit more from rapid volatility contraction

- Adjustment Triggers: Have predefined adjustment points based on both underlying price and VIX levels

- Risk Management: Consider using VIX levels as stop criteria in addition to underlying price

- Correlation Awareness: During volatility spikes, correlations between assets often increase dramatically

- IV Rank/Percentile: Even within a high VIX environment, consider relative IV compared to recent levels

- Sector Selection: Some sectors may be more attractive than others for these strategies during volatility events

Recent Comments